pinellas county sales tax 2021

Ways to Pay Property Taxes. What is the sales tax rate in Pinellas Park Florida.

Your Property Tax Bill Forward Pinellas

Floridas statewide sales tax rate is 6 percent but a majority of county governments have a local sales tax of 5 to 2 percent for various purposes including infrastructure public hospitals emergency.

. If you live in Miami-Dade County or Pinellas County you pay 1 county sales tax. The Pinellas County sales tax rate is. This is the total of state county and city sales tax rates.

Remember that ZIP codes do not necessarily match up with. Jan 01 2021 The current total local sales tax rate in Pinellas County FL is 7000. Roads bridges and trails.

TAX DAY NOW MAY 17th - There are -394 days left until taxes are due. The latest estimates put the rate reduction to take place sometime during 2024. 1st installment payment for 2022 property taxes due by June 30.

2020 rates included for use while preparing your income tax deduction. Has impacted many state nexus laws and sales tax collection requirements. Property Taxes in Pinellas County.

Pinellas County has a sales tax rate of 7 percent close to the statewide average rate of 68 percent. This rate includes any state county city and local sales taxes. So the current Florida sales tax rate on commercial rent as of January 1 2022 is 55 plus the local discretionary surtax rate.

This is the total of state and county sales tax rates. Pinellas County Florida A-8 FY22 Adopted Budget. Restaurants In Matthews Nc That Deliver.

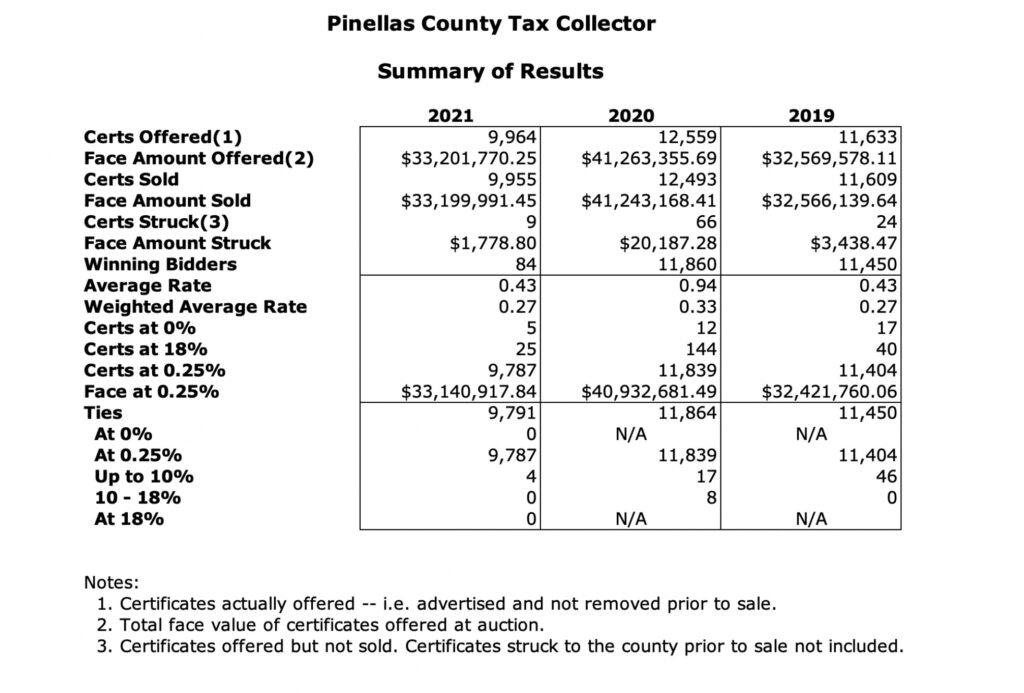

Tax Certificate and Tax Deed Sales - pinellas county tax. Pinellas County Tourist Development Tax Code. Going Out Of Business.

The current total local sales tax rate in Pinellas County FL is 7000. This is the total of state county and city sales tax rates. To review the rules in Florida visit our state.

The most populous location in Pinellas County Florida is Saint Petersburg. The latest sales tax rate for Pinellas Park FL. The most populous zip code in Pinellas County Florida is 34698.

The average cumulative sales tax rate between all of them is 7. You can register using the online registration system or submit a paper Florida Business Tax Application Form DR-1. The total sales tax rate in any given location can be broken down into state county city and special district rates.

How To File a Sales Tax Return in Florida For Resellers 2021. The December 2020 total local sales tax rate was also 7000. Majestic Life Church Service Times.

Businesses must register each location to collect report and pay sales tax. Opry Mills Breakfast Restaurants. 72 rows For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020.

Effective July 1 2021 Florida law requires businesses making remote sales into the state to collect and electronically remit sales and use tax including any applicable discretionary sales. The median property tax in Pinellas County Florida is 1699 per year for a home worth the median value of 185700. Voted to approve this one-percent infrastructure sales tax.

As we began Fiscal Year 2021 we faced a great deal of uncertainty amid the COVID-19 pandemic. Are Dental Implants Tax Deductible In Ireland. In sales tax and 73 million in bed taxes from visitors.

Property Taxes in Pinellas County Overview. 80 million available from Penny for Pinellas sales tax for affordable housing. The 2018 United States Supreme Court decision in South Dakota v.

Any certificate struck to the county at a sale will not be available for purchase until the first business day of September. 2021 Pinellas County Government Accomplishments Our Vision. There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation.

The minimum combined 2022 sales tax rate for Pinellas Park Florida is. Property taxes must be paid in full by April 1 2022 to avoid late fees. The discount drops to 3 in December 2 in January and 1 in February.

You can find more tax rates and allowances for Pinellas County and Florida in the 2022 Florida Tax Tables. The Pinellas County sales tax rate is 1. 2021 Florida Sales Tax Rates for Commercial Tenants - Winderweedle Haines Ward Woodman PA.

The Penny and sales tax rates. Tax Rates By City in Pinellas County Florida. Pinellas County has one of the highest median property taxes in the United States and is ranked 640th of the 3143 counties in order of median property taxes.

As for zip codes there are around 71 of them. The sales tax rate does not vary based on location. The Florida sales tax rate is currently.

The Pinellas County Tax Collectors Office does not set property tax rates and does not decide how much homeowners are billed. A full list of these can be found below. The Pinellas County sales tax region partially or fully covers 72 zip codes in Florida.

The state of Florida imposes 6 sales tax on the full purchase price less trade-in. Did South Dakota v. Local Option CVB Reports.

Tax Certificate Tax Deed. Update Address with the Property Appraiser. Florida has a 6 sales tax and Pinellas County collects an additional 1 so the minimum sales tax rate in Pinellas County is 7 not including any city or special district taxes.

Income Tax Rate Indonesia. To purchase Pinellas County held certificates register online at LienHub. Soldier For Life Fort Campbell.

The Florida state sales tax rate is currently. For more info about delinquent taxes please contact our office at 727-464-3409. Sales tax made easy with TaxJar.

Pete-Clearwater International Airport PIE expanded to 65 non-stop. Pinellas County Sales Tax 2021. Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1.

Pinellas County collects on average 091 of a propertys assessed fair market value as property tax. FL Rates Calculator Table. The County sales tax rate is.

There is no discount for March payments. 1 Sett 17 ing the 2021 Pinellas County Government. To be the Standard for Public Service in America.

The Pinellas Park sales tax rate is. Pinellas County Florida A-7 FY22 Adopted Budget. Official 2022 tax roll opens Nov 1.

Start filing your tax return now. Water quality flood and.

Tax Certificate And Tax Deed Sales Propertyonion

Florida Sales Tax Guide For Businesses

Pinellas County Tax Collector S Office Facebook

Archives For July 2021 Office Space Brokers

News Pinellas County Tax Collector

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Online Sales Tax Law For Businesses

Tourist Development Taxes Pinellas County Tax Collector

2022 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Cities With The Highest And Lowest Property Tax Rates In Pinellas County

Florida Income Tax Calculator 2021 2022 Zrivo

Florida S Back To School Tax Holiday Ends Monday

Florida Sales Tax Rates By City County 2022

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties